UK Limited Company Corporation Tax Returns

How to take the figures from an accounting software and to submit them to HMRC

What you will learn

Fill in an online HMRC UK Corporation Tax Return

File Companies House UK Company Accounts

Complete a confirmation statement at Companies House

How to change a Tax Return already submitted

How to take the figures from an accounting software and to submit them to HMRC

Why take this course?

This course is for small business owners and bookkeepers who need to fill in a UK Corporation Tax return for simple UK accounts and don't have the hundreds of pounds to pay an accountant to do it for them - and want to do it themselves.

This course will go through the CT600 tax form online. We start right from the beginning - taking the numbers off an accounting system (Quickbooks) and filing those figures with HMRC. We go through the form - page by page. The tax form is like an online questionnaire - answer the questions and the site itself will calculate your tax amount due.

No materials are included - but we look at a UK limited company, we file the accounts for that company with Companies House and HMRC. In addition, we also file the annual confirmation statement with Companies House. We look at how to register to file for corporation tax, how to amend a tax return if you have filled it in and submitted it already but need to change it.

The course will take approx 2 hours to complete. The purpose isn't to go into the theory of tax or its complications or to recite difficult or complicated tax law - the main purpose of this course is to show you how to fill out and complete a UK Company Tax return form - specifically the CT600. The example company used in the course is a service firm with low trading activity. We keep it simple.

Whilst the course tutor has a first-class honours degree from Middlesex University in Accounting with Marketing and has completed the AAT (Association of Accounting Technicians) - one cannot answer individual and personal tax return enquiries or complications. If you are in need of tax advice, we would suggest contacting a local tax accountant or your local HMRC tax office to discuss your private and personal tax affairs.

This course aims to demystify the task of filling out a CT600 Corporation tax return form and it goes through the entire process in a speedy, matter-of-fact way.

We also cover filing out the Companies House Annual Return - another annual administrative task which many people get charged a small fortune by their accountants to do, which they could probably do themselves.

Reviews

Charts

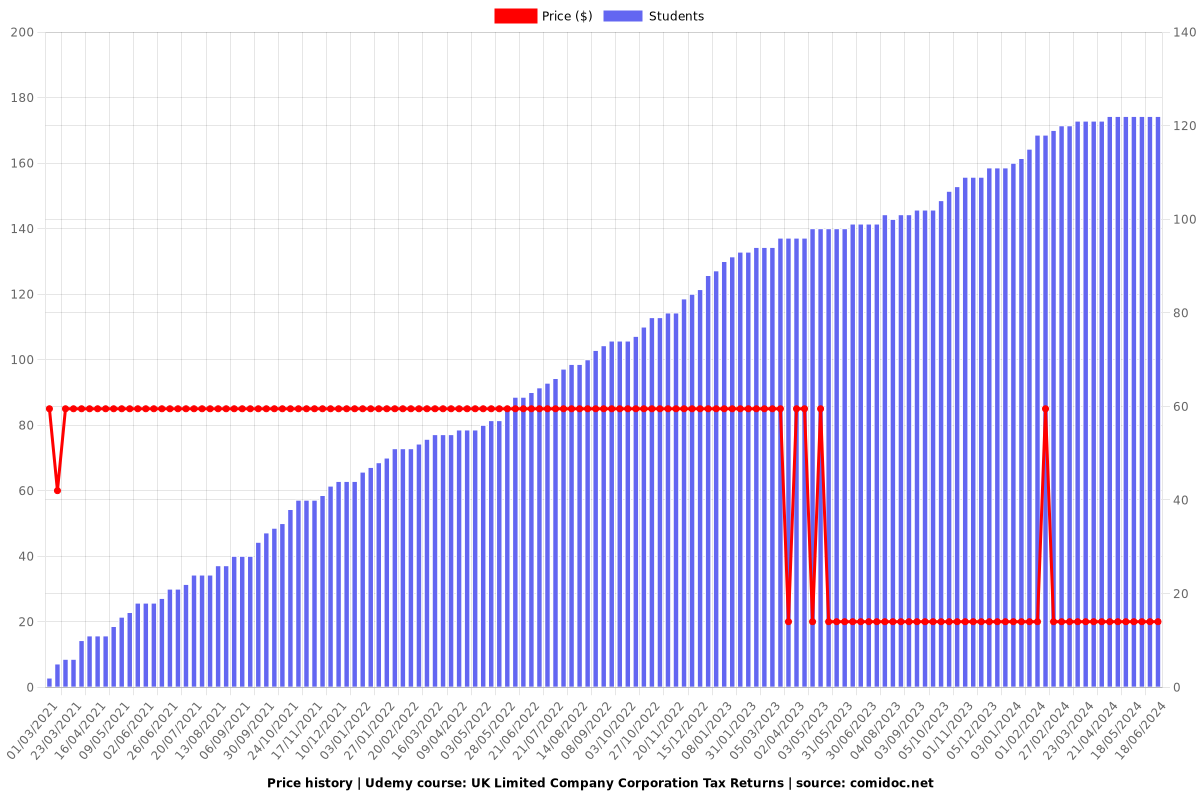

Price

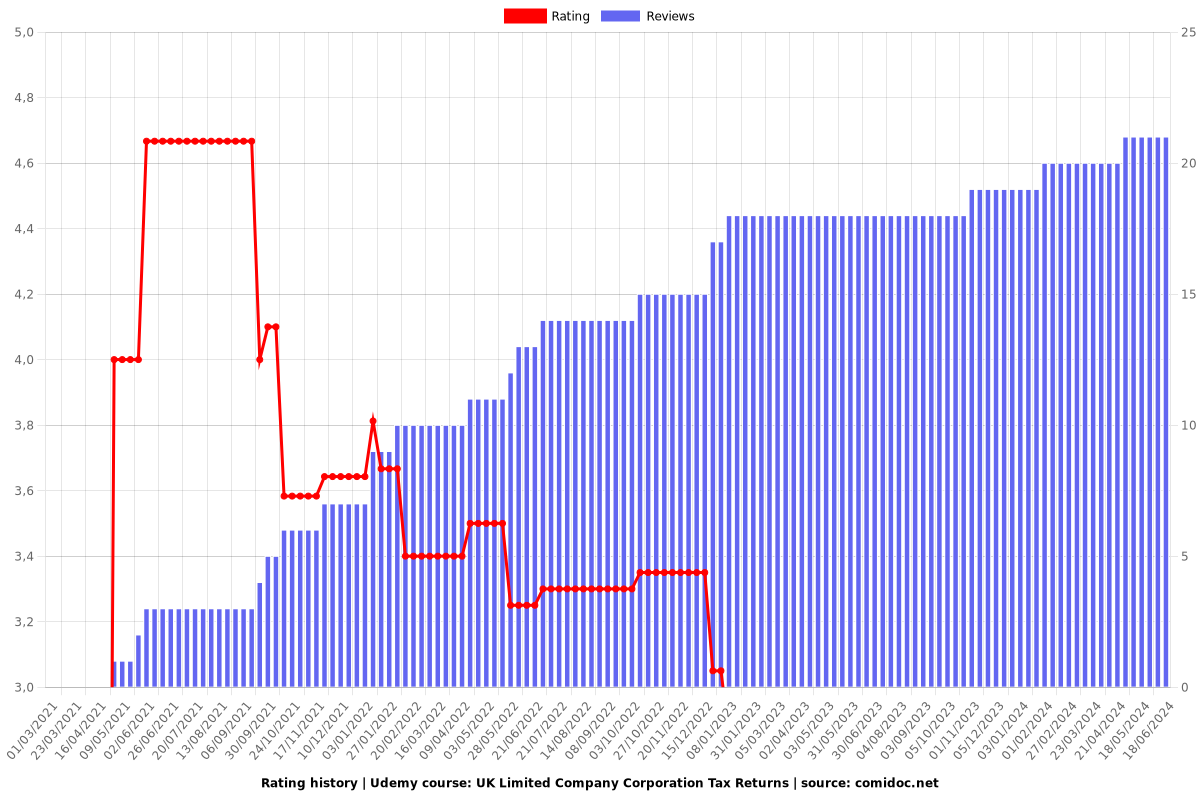

Rating

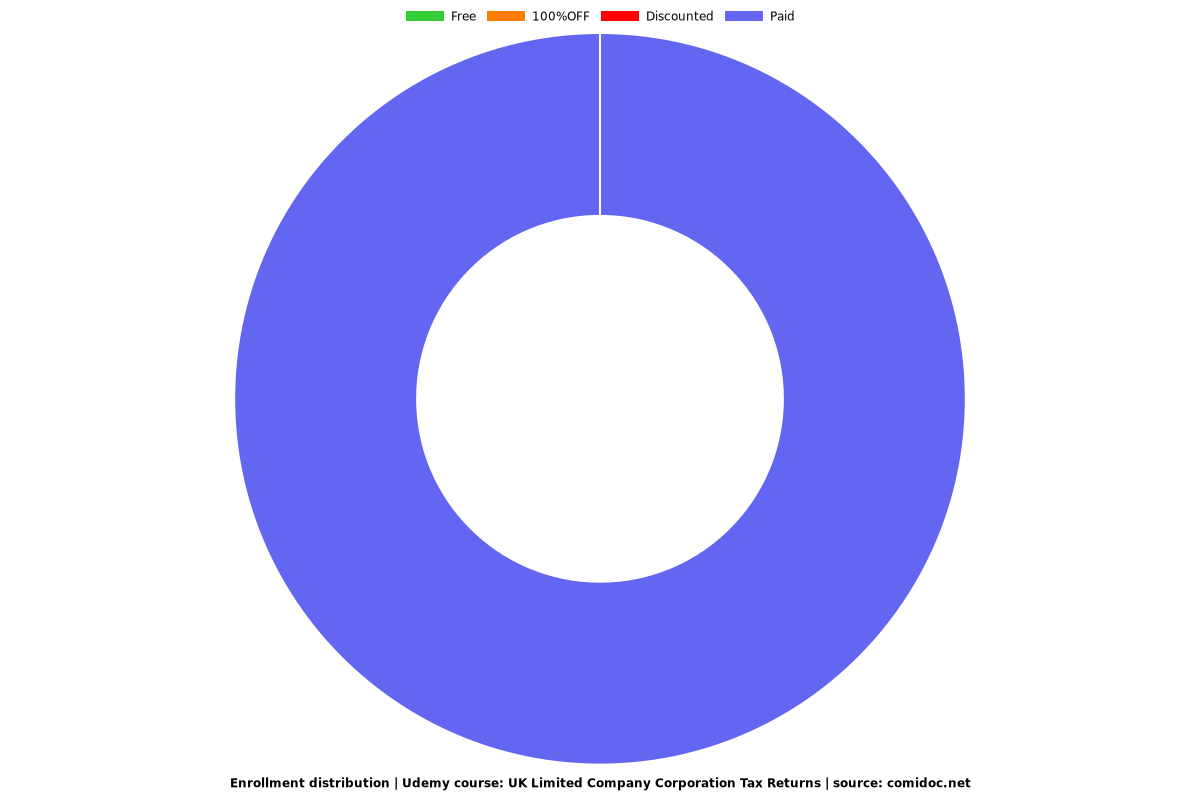

Enrollment distribution